The fraud industry has evolved in the last ten years from focusing almost entirely on simply stopping fraud and the subsequent losses, to balancing those objectives with maintaining a strong customer experience and complying with regulatory change.

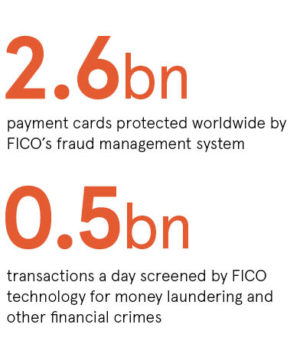

Simultaneously, criminals have evolved and become more sophisticated. Those fighting financial crime may see money laundering and fraud as the business of different departments, but criminals see no such barriers. Money obtained through fraud, or other criminal activity, is laundered through accounts almost seamlessly.

In today’s world of real-time payments, hopping the proceeds of crime through multiple accounts and out of the system helps criminals to gain control of their ill-gotten gains, and foils the attempts of law enforcement to trace and stop them.

Taking a more holistic approach to fighting financial crime is challenging. Many organisations, particularly those that have grown through acquisition, struggle with a legacy of multiple-point solutions that are embedded into core business systems. This results in silos and a lack of visibility across the financial crime life cycle; criminals take advantage of this.

A typical enterprise has both fraud and compliance departments. The fraud team is primarily responsible for fraud losses, while the compliance team helps the organisation to stay on the right side of financial crime legislation, most notably the regulations that govern money laundering and tax evasion.

The departments require much of the same information and both must take appropriate action when financial crime is suspected, but if they don’t share information then neither has a full picture of the customer. Numerous systems are maintained, which means maintaining multiple teams with their own skillsets that are not transferrable.

Customers can become frustrated with the inconsistency, such as having to provide the same information twice, and cases are often progressed inadequately when information is not available when needed. Running in silos makes the departments more costly to run, increases losses and prevents less financial crime, all impacting the bottom line.

“The fraud and compliance functions need to come together and take a holistic approach to the people, processes and solutions they use,” says Matt Cox, senior director of fraud, cyber and compliance, Europe, Middle East and Africa (EMEA), at FICO. “Then when the customer opens an account, or spends or moves money, the bank can check for money laundering and potential fraud at the same time.

“If something suspicious happens, the customer doesn’t want two different phone calls from the fraud and compliance teams. Too often that happens these days, so convergence is a must.”

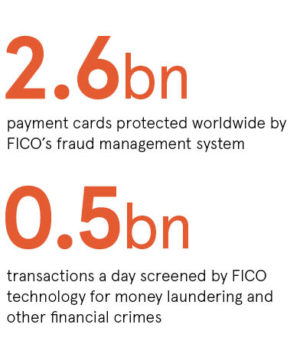

FICO is leading the enterprise management approach to financial crime by helping their clients tackle both fraud and compliance. The analytics software firm, which has the world’s leading payments fraud management system, identified the issues silos were creating several years ago and in 2016 it acquired TONBELLER, which has a large footprint in the compliance space.

“Forward-looking organisations are considering how they bring people, processes and technology together,” says Mr Cox. “Over half of our clients consider a converged financial crime operating model to be their next logical step. Convergence allows enterprises to protect all channels, protect their customers, create a consistent customer experience and maximise loss prevention and revenue. At the same time, institutions can remain compliant and can take more responsibility for financial crime across the life cycle.”

FICO’s approach to tackling all aspect of financial crime builds on its significant history of using artificial intelligence and machine-learning. FICO uses multiple, patented machine-learning techniques to look for behavioural anomalies that could indicate either fraud or money laundering.

“We were the first to bring machine-learning to fraud in the US and then took it around the world,” says Mr Cox. “Now we’re applying the technology to beat more types of financial crime.”

For more information please visit FICO.com/fraud