It is fair to say the tax department has historically been one of the most undervalued functions within an organisation. In many cases, long-term under investment means employees still struggle with outdated, time-consuming and ineffective processes.

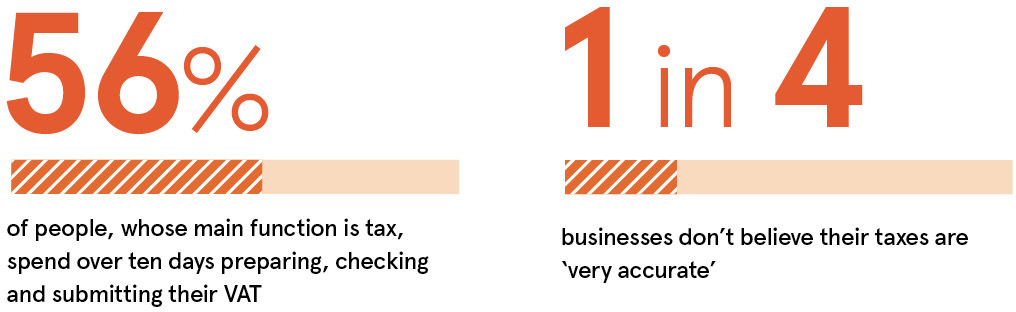

Such is the prevalence of these error-prone processes, almost a quarter of UK businesses admit they are not confident in their tax figures.

However, change is coming. The government has introduced the Making Tax Digital (MTD) scheme with the aim of making it easier for businesses to get their tax right, thereby reducing tax lost due to avoidable mistakes. With the initiative, HM Revenue & Customs hopes to create one of the world’s most digitally advanced tax systems.

The first phase of the scheme was launched earlier this year, affecting 1.2 million VAT-registered UK businesses with taxable turnover above £85,000. The next step will be to introduce digital linking between software programs in 2020. However, HMRC’s long-term vision is that all businesses and individuals who do their own taxes will submit their returns online to HMRC from their own MTD-compatible software.

At a time when the C‑suite is fixated on digital transformation, now is the perfect opportunity for companies to think about tax transformation.

The idea is to not only make tax more accurate, but to provide a greater level of transparency so management can make better business decisions based on its tax position. For example, imagine the value to the company if the tax manager could analyse historical data to predict the next two years’ returns? The tax department instantly moves from being a resource to a business enabler.

It can be argued that the stakes are simply too high not to consider automating and digitising the tax process. Paying the right tax is synonymous with good business practice, and several businesses have hit significant financial troubles because they didn’t have transparency into their finances and taxes. Investors, too, are demanding greater scrutiny into their company’s tax affairs as the reputational damage and subsequent long-term loss of business can be just as harmful as any initial fallout.

For successful tax transformation, businesses need an overarching view of their organisation so they can eliminate silos of data and tie all their systems and processes together. They should look to automate manual processes in a way that mirrors what’s happening across the rest of the business.

Arkk Solutions’ platform, for:sight, enables businesses to automate the entire process, from cleansing data to submission. This means chief financial officers (CFOs) and their teams can go beyond compliance, transforming their financial reporting to provide greater transparency, control and insight.

While it’s not necessary to throw everything out and start again from scratch as organisations can take a phased approach to transformation, it is important to keep one eye on the future, as traceability and governance will only become more central to tax reporting.

The key is engaging the right stakeholders to elevate tax up the business agenda. This means being able to highlight the benefits of investment in tax to the chief executive, the CFO and the IT department. In the same way they recognise the competitive advantages that business transformation can deliver, it’s time for the C‑suite to see the value in tax transformation and how it can elevate their business.

In 2019, it’s no longer acceptable to rely on spreadsheets cobbled together from disparate sources across the business or to extract data from ‘black box’ legacy databases to make the numbers work.

Instead of simply complying with the new MTD regulations, organisations should look at overhauling their old-fashioned processes and, moreover, consider how the tax department can start delivering real value and a competitive advantage to their business.

Interested in transforming your tax function? Please visit www.arkksolutions.com

It is fair to say the tax department has historically been one of the most undervalued functions within an organisation. In many cases, long-term under investment means employees still struggle with outdated, time-consuming and ineffective processes.

Such is the prevalence of these error-prone processes, almost a quarter of UK businesses admit they are not confident in their tax figures.

However, change is coming. The government has introduced the Making Tax Digital (MTD) scheme with the aim of making it easier for businesses to get their tax right, thereby reducing tax lost due to avoidable mistakes. With the initiative, HM Revenue & Customs hopes to create one of the world’s most digitally advanced tax systems.

The first phase of the scheme was launched earlier this year, affecting 1.2 million VAT-registered UK businesses with taxable turnover above £85,000. The next step will be to introduce digital linking between software programs in 2020. However, HMRC’s long-term vision is that all businesses and individuals who do their own taxes will submit their returns online to HMRC from their own MTD-compatible software.