Time-poor businesses face a complicated journey to capitalise on global opportunities in a post-Brexit, post-COVID world, requiring greater payments technology underpinned by human relationships

Promoted by moneycorp

It’s unlikely that small and medium-sized enterprises (SMEs) will ever be faced with a more turbulent business environment than they have been forced to steer through over the last few years. If the once-in-a-generation disruption caused by the Brexit transition wasn’t enough, the global coronavirus pandemic has presented truly unprecedented challenges for leaders.

Fortunately, both events came at the end of a decade of rapid technological advancements, affording companies the ability to carry out all necessary financial tasks in a remote, distributed workforce. Yet while technology has an incredible ability to reduce friction, it’s not able to eliminate borders altogether, which meant that when the Brexit transition period ended on January 1, the impact on financial supply chains was felt.

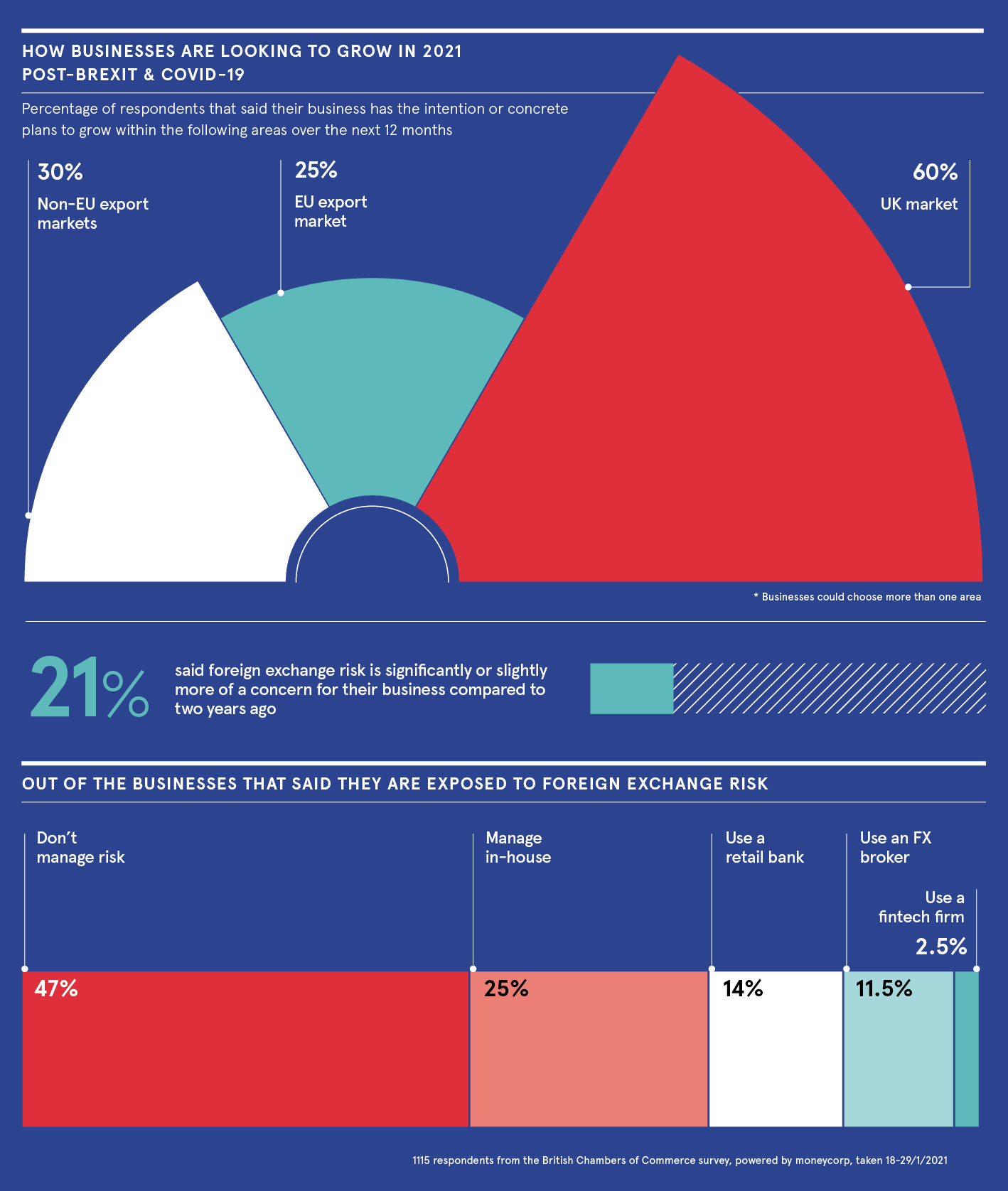

Driven by uncertainty around lockdown restrictions and last-minute Brexit negotiations, the volatility of exchange rates over the last year has affected the value of payments that businesses need to make and the balances they hold. In a recent study by moneycorp and the British Chambers of Commerce, one in five SMEs said currency risk is a greater concern than it was two years ago.

The same research presented a tale of two halves among SMEs. While 44 per cent expressed an intent to grow their European Union exports over the next 12 months, 23 per cent said they are looking to reduce their EU activity. Additionally, a third of SMEs also intend to grow in international markets. With completion of Brexit, and the government’s aim to relaunch the UK as a business hub for the rest of the world, there are clear opportunities to trade more efficiently and affordably with countries that were unavailable or impractical when the UK was in the EU.

For companies establishing European offices and exploring supply chains out of the EU, particularly in emerging markets that wouldn’t historically have seen that business, it’s crucial they manage their currency risk. Yet more than 90 per cent of SMEs are neglecting to do so, the study found, with business leaders blaming the costs of foreign exchange management and a lack of available information about their exposure.

To support SMEs, moneycorp has carved out its own space in the middle of the market, providing technology with a specialist, human touch

They need to work with an international payments partner that meets their unique needs, but struggle to find help among the two key groups of providers: new challengers in the space and generalist banks.

“New challengers, on one side, are completely digital-based,” says Lee McDarby, UK chief executive of moneycorp, one of the UK’s fastestgrowing international payments companies. “They are very streamlined towards the development of apps and the technology is good, but if something happens to your payment, it’s extremely difficult to pick the phone up and actually speak to someone.

“On the other side, retail banks might offer a human to engage with, but they are very much generalists offering lots of financial services to a variety of customers, all the way through the spectrum of size. Through my many interactions with SMEs, I can tell you what they want is simple, but it’s not being served by either party: a specialist provider with tech they can access when they want and strong, human-led customer service.”

It’s important companies take a critical look at their payments processes and consider how they can be streamlined to protect their bottom line, especially with international transactions. Some businesses are more savvy on outward payments, but far less so on inward payments. However, if a supplier sends dollars to a company’s sterling account, for instance, it is at the mercy of what the bank is charging that day.

To support SMEs, moneycorp has carved out its own space in the middle of the market, providing technology with a specialist, human touch. Its international bank account simplifies payments, allowing businesses that trade with markets outside the UK to boost their profitability by receiving, sending and holding in all the major currencies. SMEs also avoid the various set-up fees other providers impose, account management fees, unfair conversion charges and excess admin for multiple accounts.

Having invested heavily in modernising its digital platform, moneycorp’s technology holds its own against the fintech apps. There is functionality for smaller SMEs needing to receive and send multiple currencies with a simple spot or lock-in rate for a future payment, up to larger companies requiring bulk payment capability, which is especially desirable for businesses that upload and validate thousands of payments at a time.

To advance its technology further, moneycorp has developed a series of application programming interfaces, or APIs, whereby time-poor companies can plug in their accountancy software to gain a much more streamlined way of dealing with their international risk, overseas payments and foreign exchange requirements. The ability to plug everything into one place is particularly in demand among larger SMEs in sectors such as insurance, shipping and the gig economy.

“A lot of our technology investments have been focused on giving treasurers, finance directors and chief financial officers the time to focus on higher-value tasks,” says McDarby. “We are acutely aware payments are a big part of a business, but there are also many other parts that need attention from finance leaders, so we are very dedicated to integrating digital innovation in a way that takes the stress out of the payments journey for SMEs.”

The ability to access and interact with a payments expert also means moneycorp can offer valuable market guidance to SMEs, particularly against a turbulent backdrop of Brexit and COVID-19. Many business leaders do not have the specialist knowledge to interpret a currency chart and decipher what it means for their business and they can’t get that from an app either.

Awareness of how a business is transacting against their budget rate is imperative, to avoid inadvertently eating into their bottom line, so a direct relationship with a specialist is hugely valuable.

“Customers have told us that while they are passionate about their businesses, they are time-poor,” says McDarby. “They can’t wear all the hats required to run their company, so we lend that extra, safe pair of hands. Both challenges and opportunities for growth lie ahead. SMEs can focus on their priorities and workforce as we help them keep an eye on the financial markets and stay ahead of the curve. We’re a natural extension of their financial operations and we do that well because of our tech, but also our human touch.”

For more information please visit www.moneycorp.com/future or call + 44 (0) 203 797 2944

moneycorp is a trading name of TTT Moneycorp Limited, a company registered in England under registration number 738837. Its registered office address is at Floor 5, Zig Zag Building, 70 Victoria Street, London SW1E 6SQ and it is VAT registration number is 897 3934 54. TTT Moneycorp Limited is authorised by the Financial Conduct Authority under the Payment Service Regulation 2017 (firm reference number 308919) for the provision of payment services. Moneycorp Bank Limited is authorised and regulated by the Gibraltar Financial Services Commission. Moneycorp Bank Limited is a company registered in Gibraltar under company number 113151 with its registered office at suite 7/b King’s Yard Lane, Gibraltar, GX11 1AA. Telephone: +350 (0) 2225 5600

Promoted by moneycorp

Related Articles

Time-poor businesses face a complicated journey to capitalise on global opportunities in a post-Brexit, post-COVID world, requiring greater payments technology underpinned by human relationships

Promoted by moneycorp

It’s unlikely that small and medium-sized enterprises (SMEs) will ever be faced with a more turbulent business environment than they have been forced to steer through over the last few years. If the once-in-a-generation disruption caused by the Brexit transition wasn’t enough, the global coronavirus pandemic has presented truly unprecedented challenges for leaders.