Supply chain leaders discuss managing disruption in their transport networks, making long-term investments and how logistics visibility is evolving

Sponsored by Alpega

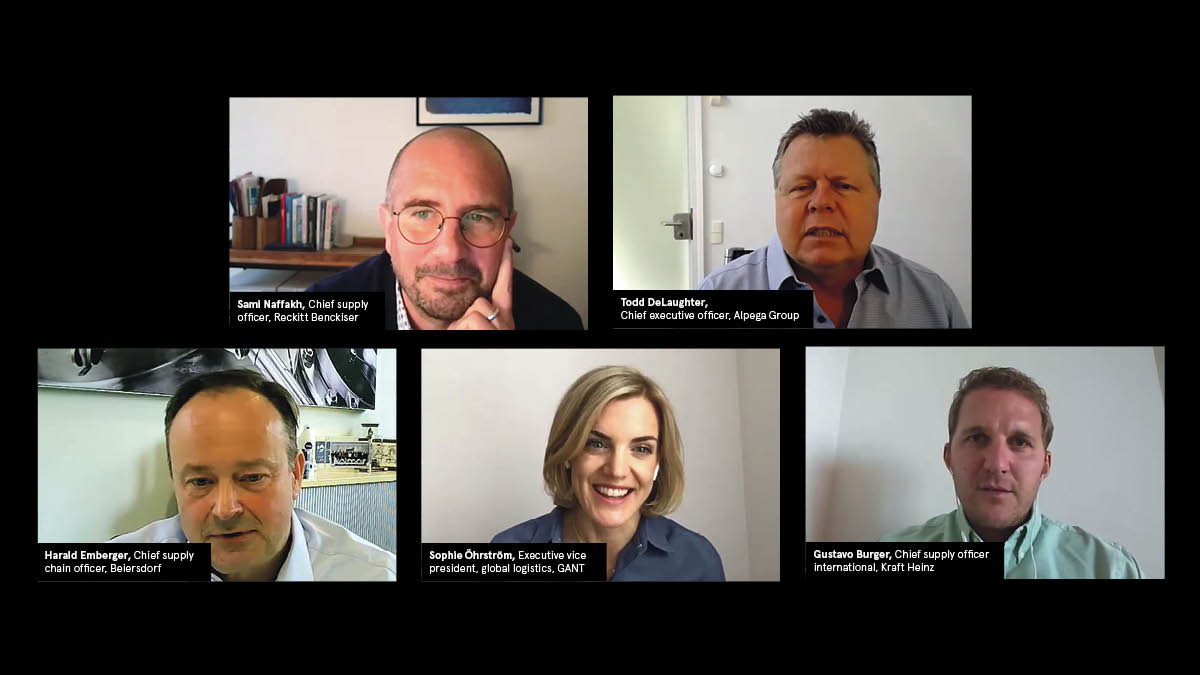

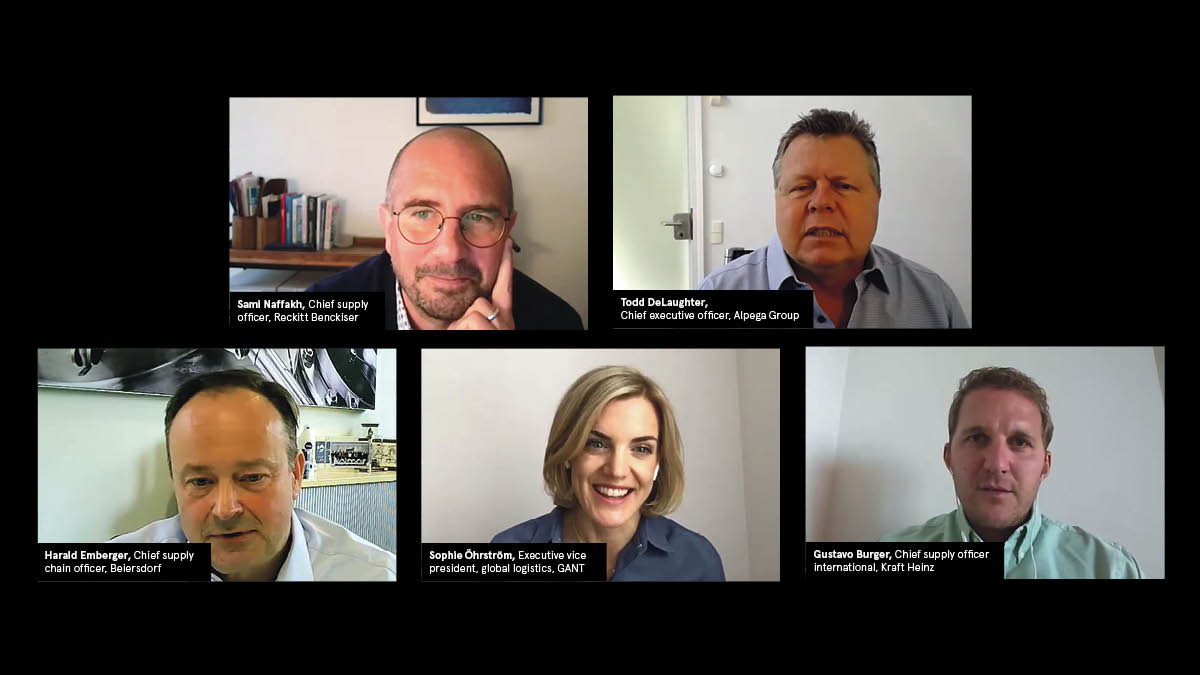

Sami Naffakh, Chief supply officer, Reckitt Benckiser

Harald Emberger, Chief supply chain officer, Beiersdorf

Todd DeLaughter,

Chief executive officer, Alpega Group

Gustavo Burger, Chief supply officer international, Kraft Heinz

Sophie Öhrström, Executive vice president, global logistics, GANT

How have you managed the disruption of the past months – coronavirus, the container crisis and Suez Canal blockage – and what tools have helped you navigate?

SO: The whole of 2020 was a supply chain rollercoaster, starting with limitations in supply from Asia and Europe. Then once the supply started to increase again, sales in Europe were impacted by lockdowns and warehouses were overfilled with products. It’s been a matter of controlling the information and build really close co-operation and trust with internal as well as external stakeholders.

GB: At the very early stages of the pandemic, we had daily calls with all plant managers to empower them to make decisions at local level. They would have to ask two questions. Is this decision helping protect the health and safety of our people? If yes, go ahead. Is this decision helping produce more food? If yes, go ahead.

TD: Alpega is involved in transportation management software and freight exchanges with customers who are producing and shipping goods all over the world. We saw early on, some industries declining in terms of volume and others spiking. So the ability to handle these swings in demand was key for our customers with tools like spot bidding and at the same time providing access to our Teleroute freight exchange platform to carriers for free during the pandemic’s initial months.

HE: In 2017, we were hit by a cyber-attack. This made us revisit our business models, our capabilities. [So all of that] helped us with [the Covid-19] crisis.

SN: On the hygiene, disinfection side, we saw huge spikes, up to 25 times pre-Covid volumes. So, there’s been huge responsiveness to put in place additional capacities, most of which are onshore. That helped with the transportation disruption later.

For us to navigate the future, it’s critical to understand not where the demand is, but where the demand will be

What processes can you put in place to help mitigate against future disruptions?

SN: This whole situation of super high volatility and unpredictability has changed the dynamic of the relationship with key customers. And there’s been much more appetite for close collaboration, sharing of data and building joint forecasts.

SO: When something like the Suez Canal ship blockage happens, the first question you get is what is the impact on our goods? Arrival of the goods is essential when planning our seasons and all related activities. Being able to have full visibility is key.

How have you worked with internal stakeholders to ensure success?

GB: We became very agile because we had cross-functional collaboration, not only within the company, but outside it. Very quickly, the different stakeholders understood we needed to remove complexity from the system. The pandemic became a catalyst of transformation and agility.

What have the events of the past year taught you about the need for real-time visibility in your network?

SO: Order visibility is the foundation for controlling your supply chain. The next step is to flexibly re-route and optimise from where your orders are fulfilled. But you cannot start without having visibility and data.

HE: We looked into how much a buffer costs. Within our resilience programme, we showed estimates to the organisation. This is a really good point, to make it visible and say look, how much are we prepared to pay for insurance? You cannot run hand to mouth every day and in every part of the supply chain.

TD: This discussion is about visibility in real time, but it’s only to the extent you can take the analytics of that information and affect your advanced planning, because the idea is not to have to be in a reactionary mode but, as others have stated, to build in buffers and do that through your planning process. We offer an advanced planning solution with growing numbers of users, but still maybe 5 per cent of companies do advanced planning. Lots of room to improve.

How will real-time visibility set your business up to better manage disruption and win competitive advantage?

GB: In the food industry, there is an interesting dynamic that brands travel and products don’t, because taste is very local. For us to navigate the future, it’s critical to understand not where the demand is, but where the demand will be. That’s where analytics can help us a lot.

SO: In the fashion industry, many products are intended for one specific season, which means it’s crucial goods arrive in time. For us, having the visibility and ability to predict when the goods are expected will help us plan and steer our resources more efficiently.

What have you learnt over the past 12 months that will help future-proof your business when predicting transport costs is more challenging than ever?

SN: We’re doing a lot of work on having the right balance between offshoring and onshoring, which would reduce the dependency on ocean and air freight. We’re also looking at rail to go from Asia into Europe.

HE: Our focus is not only costs, but also the impact on carbon footprint. How do I take trucks off the road and get fuller loads and fewer movements, preferably by rail? The second thing is we need to reduce the complexity in our assortment to get a more efficient supply chain.

TD: Advanced planning, as we discussed. Sixty per cent of the goods in Europe move by road. But at any given point, 40 per cent of the trucks on the road are empty. I think that’s where we as software vendors have a huge opportunity to fill those trucks up on the backhaul [return journey]. We save cost for shippers and carriers, and reduce the carbon footprint in the process.

Will you be more willing to make upfront investments in your supply chains for the sake of long-term resilience?

SN: The short answer is yes. We’re investing in buffers, in working capital. We’re investing in additional capacities, in capabilities.

GB: Investing ahead of the curve in things that really matter is actually a top-line visibility, not a bottom-line constraint.

HE: It’s the same on our side. I’m persuaded that we need to invest in targeted measures, for example even in raw material prices, to become more resilient.

TD: The pandemic has stressed supply chains everywhere this past year. But it is rewarding to see supply chain organisations moving into a more strategic role with visibility at the highest levels in all companies and this has been a consistent theme from all the panellists. Transportation management is one of the areas where we can help supply chains digitally transform companies, adding flexibility, saving time and money, and reducing the carbon footprint.

For more information please visit alpegagroup.com/en/tms

Sponsored by

Related Articles

Supply chain leaders discuss managing disruption in their transport networks, making long-term investments and how logistics visibility is evolving

Sponsored by Alpega

Sami Naffakh, Chief supply officer, Reckitt Benckiser