With 11,500 branches nationwide, the Post Office has the single biggest retail network in the UK. It also carries out more than 10 million identity-based transactions annually.

Unfortunately, those transactions aren’t all plain sailing. The sheer volume of different identity policies in play and the many different documents required for face-to-face authentication has historically been a big challenge for this legacy business – made worse by an inability to seamlessly link in-person and digital transactions.

“As a portfolio business, we handle so many different transactions and an awful lot of services that require ID,” explains the Post Office’s identity services director, Elinor Hull. “Whether you’re picking up a parcel, buying euros or wanting to get cash out of your bank account, you’ll need ID. And one of the hardest things our postmasters face is knowing what ID they can accept with which transaction, because we work with third parties for many of these services, which each have their own identity policy,” she says.

Customers are also confused, says Hull, as they don’t understand the rationale behind these different policies.

And those are just the problems that might be encountered during the first stage of the transaction. Beyond establishing which ID can be used, the process of ascertaining whether the ID itself is genuine has long caused issues. “Our postmasters aren’t identity document experts,” says Hull. “It makes them nervous if they have to question whether a passport is genuine or they aren’t sure about the bond on a driving licence.”

These problems have been known to cause real friction and arguments for both postmasters and consumers. “It’s not what we wanted, or how we wanted to service customers,” says Hull.

Adapting, though, hasn’t been easy. Initial attempts to help customers access government services through Gov.UK Verify ran aground when it was confirmed earlier this year that the system would be discontinued in April 2023 after take-up was lower than expected. Even so, Hull says that the Post Office remains clear about the need to go further with integrating digital and face-to-face identity transactions.

“We’ve been around for 360 years, and we definitely don’t want a Blockbuster moment,” she says. “We’re constantly looking to evolve, to ask how we can still be relevant in customers’ lives and how we can leverage the trust they’ve placed in us.”

As a portfolio business, we handle so many different transactions and an awful lot of services that require ID

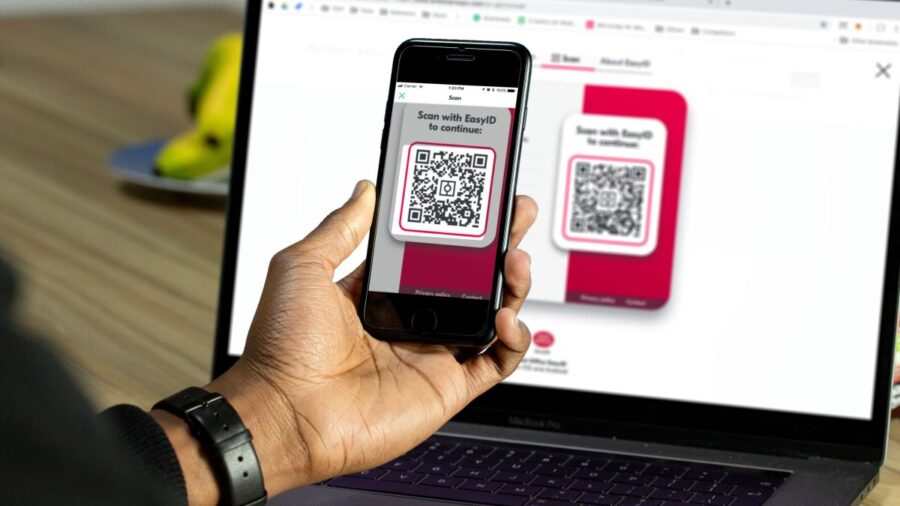

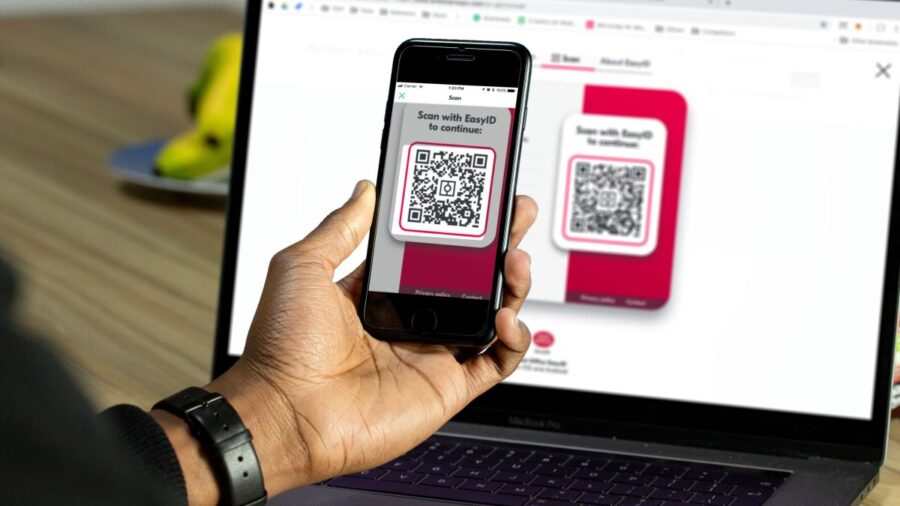

In response to these challenges, Hull launched a partnership with digital identity and biometric authentication experts Yoti. This partnership has produced a free-to-use EasyID app, which Hull describes as the Post Office’s “biggest identity-related success” to date. The app combines customers’ personal data and biometrics to create a secure, reusable ID on their phone. That’s in addition to in-branch services for those customers who do not have access to a smartphone or who prefer face-to-face contact when confirming their identity.

Naturally, security has been a priority. Customers using the app can simply hold their phone up to the postmaster to show the single piece of identity information relevant to that transaction, in bold and backlit, with a recent photo to accompany it. And to safeguard privacy, identity attributes are all stored separately, with only the individual having the key and the ability to link all these pieces of information together.

“A product like this helps reinvent and refresh the Post Office brand, showing that we’re more than just bricks and mortar,” Hull explains.

The app also demonstrates the Post Office’s ongoing transformation into a digital identity service provider (IDSP). For instance, companies can now use Post Office and Yoti identity verification services for fraud detection, e‑signatures and customer authentication, all done via secure biometric face matching and Liveness Detection.

The app’s not the only change, either. The Post Office has also introduced other identity services, including the Pass card, a physical photographic proof-of-age card ID aimed at young people. “We’re removing some of those barriers,” says Hull, “starting with the ability to prove your identity full stop, and then your ability to interact digitally.”

This year, the UK government released its updated Digital Identity and Attributes Trust Framework, which defines rules, standards and governance oversight for IDSPs. The aim is to establish the basis for a digital identity that is as trusted as using passports or bank statements. And in June, the Department for Digital, Culture, Media and Sport named the Post Office and its partner Yoti as the UK’s first certified IDSP.

“It has been profound for us,” says Hull. “I guess it’s the thing we’ve been waiting for, for years. Ultimately, it’s the gold standard. It’s the sign that your product and service can be trusted. And that’s what’s been lacking in accelerating UK adoption.”

Hull points out that the recruitment sector is already using the Post Office’s digital ID technology to great success. The Post Office has also just completed a series of trials with supermarkets, testing the use of digital ID as proof of age for alcohol purchases.

Her ambition now is to participate in a sweeping standardisation of digital identity. Higher adoption rates and more collaboration between industries will be the key to making that a reality.

To date, 3.5 million UK customers have downloaded digital identities via the Post Office’s partnership with Yoti, which Hull says is good but not good enough. “We need to be much closer to 5 or maybe 10 million to have the kind of authority that will reassure businesses that customers will have a seamless transaction. And equally, I can be an advocate of the product, stand from the rooftops and scream about it, but unless there are places to use it, then it’s just smart technology, and nobody will care.”

It is, then, partly a cultural change that Hull has in mind. “Just like the payments sector’s digital transformation, where it’s gone from cash to digital payments – such that I don’t even think about how I’m making a payment now; I can just double-click my Apple watch and it’s done – we need the same with digital identity,” she says. “We’ll have been successful when everybody stops talking about digital identity.”

With 11,500 branches nationwide, the Post Office has the single biggest retail network in the UK. It also carries out more than 10 million identity-based transactions annually.

Unfortunately, those transactions aren’t all plain sailing. The sheer volume of different identity policies in play and the many different documents required for face-to-face authentication has historically been a big challenge for this legacy business – made worse by an inability to seamlessly link in-person and digital transactions.

“As a portfolio business, we handle so many different transactions and an awful lot of services that require ID,” explains the Post Office’s identity services director, Elinor Hull. “Whether you’re picking up a parcel, buying euros or wanting to get cash out of your bank account, you’ll need ID. And one of the hardest things our postmasters face is knowing what ID they can accept with which transaction, because we work with third parties for many of these services, which each have their own identity policy,” she says.