Since the 2008 financial crisis, the UK business lending landscape has changed considerably. Bank lending to small and medium-sized businesses (SMEs) has reduced dramatically and overdrafts for SMEs have been withdrawn at a rate of £5 million a day since 2011. This has starved businesses of the vital finance they need to grow, damaging the economy in the process.

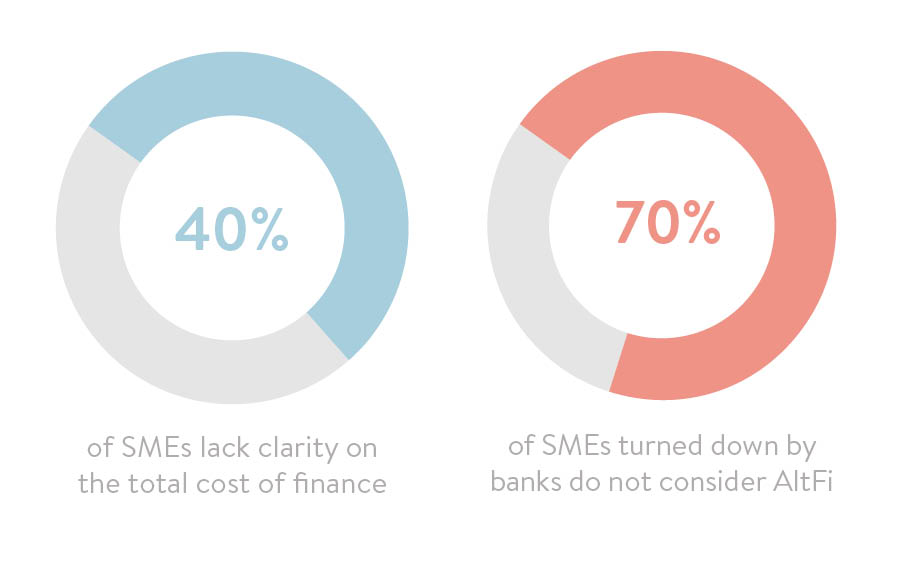

Ironically, there is liquidity in the market to fund lending; it has just been unable to find a route to borrowers. This liquidity, combined with the lending drought, has fuelled the growth of the alternative finance (AltFi) sector.

AltFi lenders offer a different range of finance products, frequently using technology and data to make lending decisions, typically via online platforms, with a seamless customer experience and in a fraction of the time it takes traditional lenders to arrive at a decision.

AltFi has seen exponential growth and is projected to hit £12.3 billion in 2020 – ten times higher than in 2014 – and the sector has clear UK government support via the British Business Bank, which has so far invested £60 million in the AltFi sector to facilitate lending to SMEs.

Innovative solutions, such as Verus360’s online revolving finance, give businesses much greater flexibility and address a range of funding needs with cost-effective finance

You may have heard about AltFi and maybe even considered taking advantage of the benefits it can provide. However, this is a noisy sector, with hundreds of providers and products each promising a unique proposition. Essentially, most AltFi products fall into three broad categories:

- Peer-to-peer (P2P) business lending – an online marketplace where investors are matched with borrowers and the provider merely acts as an intermediary

- Crowdfunding – where a large number of investors invest in a company, typically taking a share of the business they lend to

- Invoice trading – where you sell your invoice to a lender at a discount to accelerate your cash flow.

So what are the key considerations when contemplating AltFi solutions?

Do you really need to borrow?

Knowing why you need to borrow may sound obvious; you may be in growth mode and have to buy more stock, hire more staff or fund new contracts. However, it may also be due to issues with working capital because your customers aren’t paying you quickly enough. In that case, the first question to ask is whether you can get these payments back on track, rather than borrowing money.

Match your finance to your needs

Make sure that you get the right finance for your business. Certain types of finance align well to certain types of needs; for example, lease finance to fund vehicles or machinery. But taking out a long-duration, fixed-term loan may not be suitable to meet short-term borrowing and vice versa. Innovative solutions, such as Verus360’s online revolving finance, give businesses much greater flexibility and address a range of funding needs with cost-effective finance.

How much does your borrowing really cost?

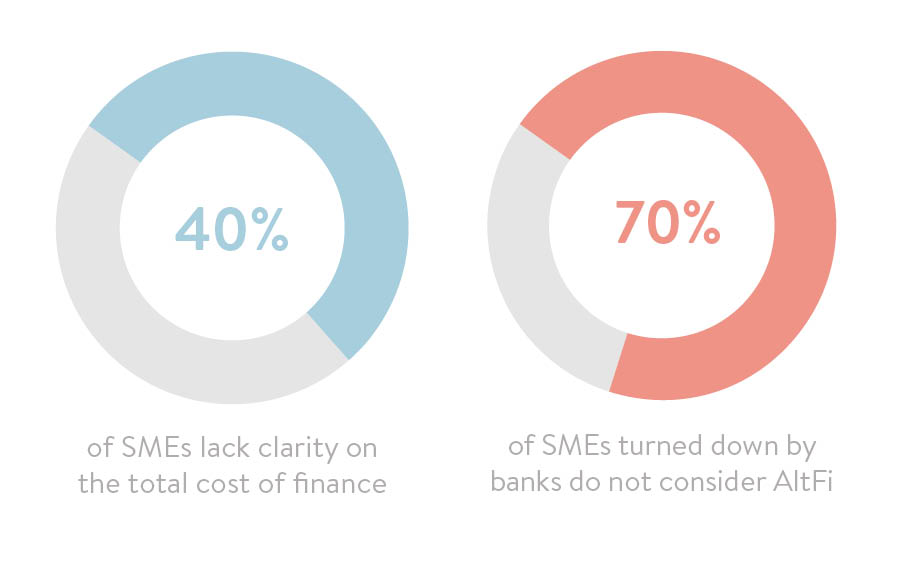

Borrowing money is one of the most critical business decisions you will make, so it’s vital that you understand the true costs involved. Our research has shown that 40 per cent of UK businesses are unsure what they’re paying for their finance. The headline rate can often seem attractive, but there may be additional costs, such as penalties if you go over your agreed limit, or administration fees, which make the total cost of borrowing far higher. Verus360 has decided to take a stand against these hidden costs by offering flexible business funding, and charging interest only on the funds businesses use and for the time they use them.

Make your finance facility work for you

Ask how your loan will operate, and work out how much time it will take to apply for and manage the money. Lending platforms, such as Verus360’s, connect securely to a business’s accounts software to offer a credit facility that’s similar to a secured overdraft. A business can apply online, get a decision within the hour, and access funds within days, making the offering more responsive to customers and driving greater choice.

What is at risk if you borrow?

Some lenders offer unsecured loans, others take security against the business via an industry-standard debenture, while others take it via a personal guarantee from individual directors. You need to have peace of mind about the security that you provide; Verus360 doesn’t ask for personal guarantees.

Make your data work harder for you

Technology and data are revolutionising the customer experience. Online accounts analysis enables AltFi firms to offer businesses fast access to finance as well as playing back valuable data on business performance. Verus360’s platform provides a personalised dashboard for its customers with valuable business information. Businesses that can capitalise on the competitive advantage this data provides will be able to grow faster.

And the future?

SMEs are the lifeblood of the UK economy and deserve better. The positive reaction to Verus360’s pay-as-you-use finance and transparent pricing is clear evidence that businesses are looking for fairer funding. How quickly “fair” becomes the norm for business borrowers remains to be seen.

Tony Morgan, chief executive Verus360