The race is on between vehicle manufacturers and technology firms to bring driverless cars to market. But a major new study of 3,000 road users shows drivers are unprepared for the changes this technology will bring.

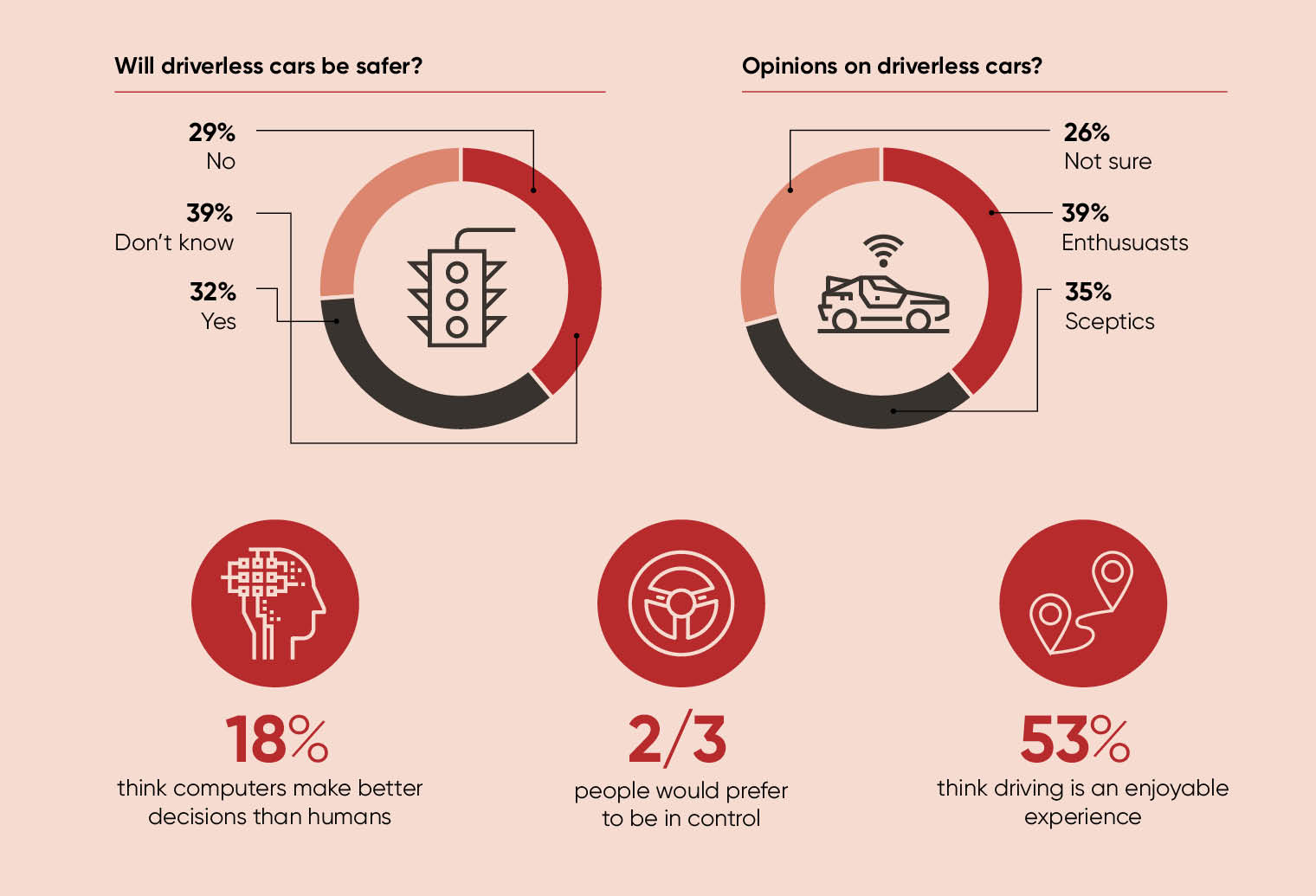

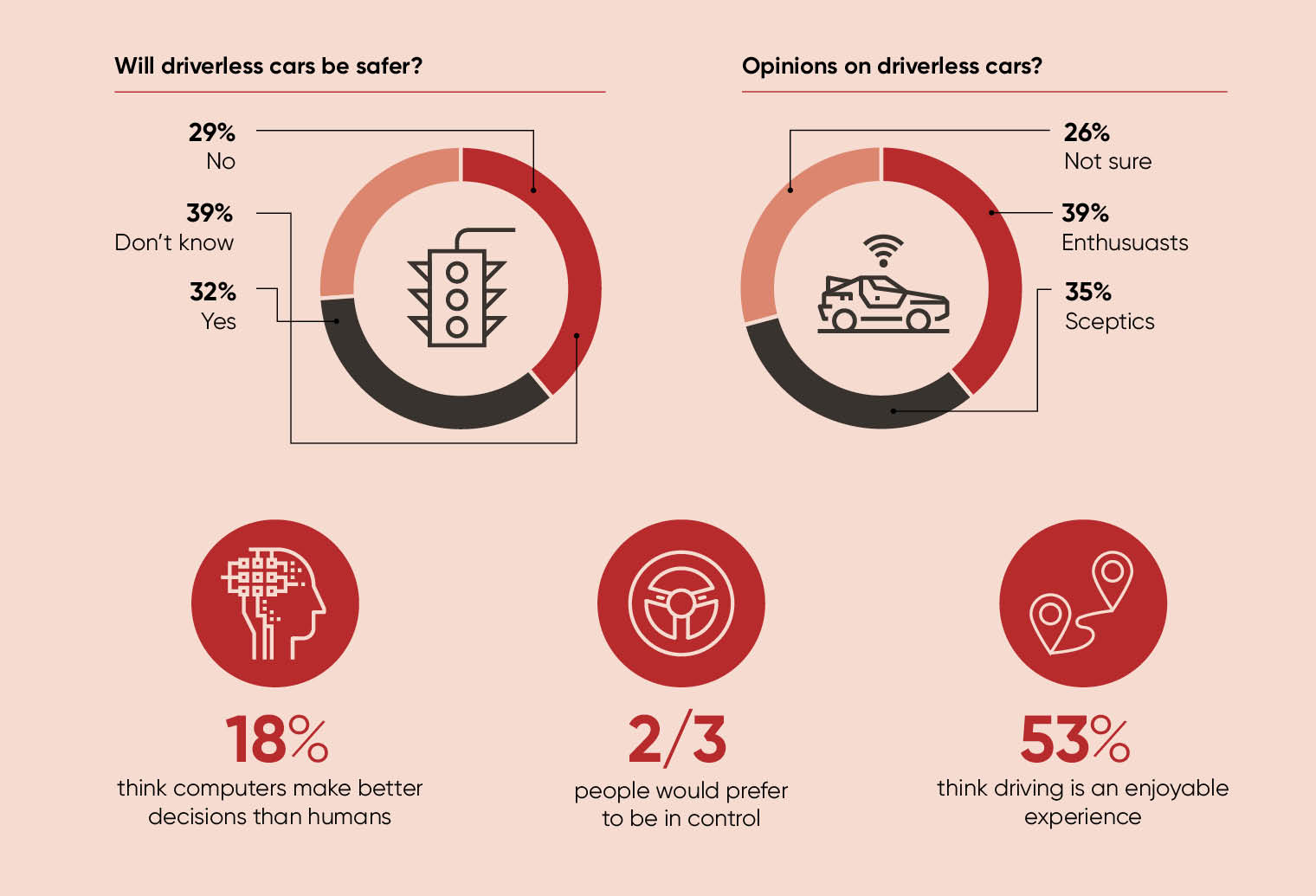

The report, by insurer Direct Line Group, reveals that only 39 per cent of UK citizens feel confident to embrace driverless technology, while more than a third are sceptical of its benefits. The study categorises UK drivers based on their views of in-car technology.

Seven distinct segments were identified through the research and this found the openness to driverless technology is shaped by attitudes, not demographics. The groups are techno geeks, automation optimists, metropolitan families, middle-laners, next-generation petrol heads, retro petrol heads and risk-averse traditionalists.

The research highlights concerns for safety and a lack of trust in autonomous technology as key barriers to adoption of driverless cars. At the moment, only 18 per cent of UK citizens believe that artificially intelligent machines would make better decisions than humans. Among them, middle-laners, who are more likely to be low-mileage drivers, are particularly unconvinced of the eventual safety or affordability of driverless vehicles.

Meanwhile, experiential benefits such as enjoyment of driving also prevent drivers considering driverless cars. Some 53 per cent say they enjoy driving and would not want this pleasure taken away. They include those classified as petrol heads and risk-averse traditionalists. Furthermore, two-thirds would prefer a vehicle in which they are in control most of the time, with technology only intervening in an emergency.

“Consumers are in the early stages of the journey into autonomous technology. They are getting accustomed to features on new cars such as autonomous emergency braking and lane correction,” explains Dan Freedman, director of motor development at Direct Line Group.

Mr Freedman is convinced that the willingness to adopt driverless vehicles will increase as they become used more widely and customers become accustomed to the technology. He adds: “There are a number of groups who already acknowledge some of the likely future benefits of driverless cars, namely convenience and time-saving. However, when more cars with automated driving features are seen safely operating on the road, these technologies will become of greater interest to the majority.”

But there are several groups who are more likely to adopt the technology, especially those who find driving dull or see it as a means to an end. These include in-car techies, who love to drive and believe technology enhances their experience.

Consumers are in the early stages of the journey into autonomous technology

Equally, metropolitan families, who make up 16 per cent of respondents and are likely to be young, live in London and want in-car social media updates, are convinced driving can be improved by the technology, even if they question some of the safety benefits.

Automated optimists, who make up 12 per cent of respondents, really trust technology and are positive about it being in control. This group, who are typically keen for less stressful and safer journeys, tend to describe driving as being uninteresting.

The people who ultimately use these vehicles will need to know the impact of their choice upon insurance. “Another challenge will be how other road users interact with these autonomous vehicles and, for instance, how accidents involving vehicles with these future technologies are dealt with,” says Mr Freedman. “The government’s upcoming Automated and Electric Vehicle Bill will likely help address where liability resides and remove one area of uncertainty.”

Clearly, there are already potential risk reductions on offer from cars with advanced driver assistance systems, which include features such as autonomous emergency braking. But the risks associated with vehicles crashing and who would be liable when technology is involved in making more of the decisions pose concerns for drivers, insurers and manufacturers.

“Advances in driverless technology will cause seismic shifts for the motoring and insurance industry, and we need to understand what people’s attitudes, emotions and behaviours to this new technology will be,” says Paul Geddes, chief executive at Direct Line Group. It is essential the potential benefits for road safety are properly communicated and that customers are supported as they move to the new technology.

For insurers, the challenge is to measure risk properly and to be clear about liability. The study reveals that questions over liability are a major challenge for the industry, with 45 per cent of people believing manufacturers of driverless technology should be accountable in an accident. “Direct Line Group and the wider industry have a critical role in the development and adoption of driverless cars on our roads, and how we can better protect the public in the future,” adds Mr Geddes.

Direct Line Group is part of two major projects studying automated driving technology in practice. These include MOVE_UK, which is examining how to accelerate the development and validation of automated driving systems, and soon-to-begin Streetwise that will look at development of advanced driver assistance systems and consumer services. Direct Line Group’s inclusion in these projects is an indication of the important role of insurers in supporting development.

Advances in driverless technology will cause seismic shifts for the motoring and insurance industry

As these technologies become more complex and sophisticated, insurers will need to evaluate their effectiveness at reducing road risk, and draw this understanding into underwriting and eventually pricing. Mr Freedman says: “The motor insurance industry has a role to play in communicating the potential safety benefits, through our willingness to underwrite such cars, and in driving adoption through lower insurance premiums where we feel they significantly reduce risk.”

Direct Line Group is working to bring together car manufacturers and insurers, through dialogue and supporting research into the risk and liability landscape. This will be essential in securing more accurate insurance, protecting customers effectively and supporting the development of safer roads.

To find out more about Direct Line motor insurance please visit directline.com