In recent years, the role of the chief financial officer has gone through a profound transition, and now they find themselves at the heart of the company, heavily involved in shaping strategy and controlling outcomes of a business. A recent study by KPMG showed that 75 per cent of chief executives see the importance of the role increasing faster than any other member of the C‑suite.

The rapid evolution of the CFO could be traced back to the financial crisis of ten years ago, where in volatile and uncertain times a financial mind that guided a business through the turmoil became an invaluable asset to the company. From there, CFOs were pulled from behind the curtain and into the spotlight of being seen as not only a finance leader, but also a business leader.

Today, companies are more globally spread out and interconnected than ever. As they continue to grow and expand into new markets, this can increase the complexity of the challenge a CFO faces, from exchange-rate volatility to regulatory pressures, increased risk and cost-cutting. A further headache is provided in dealing with the expectations of the chief executive to demonstrate more than numerical prowess to deliver above and beyond by giving support on strategic decisions.

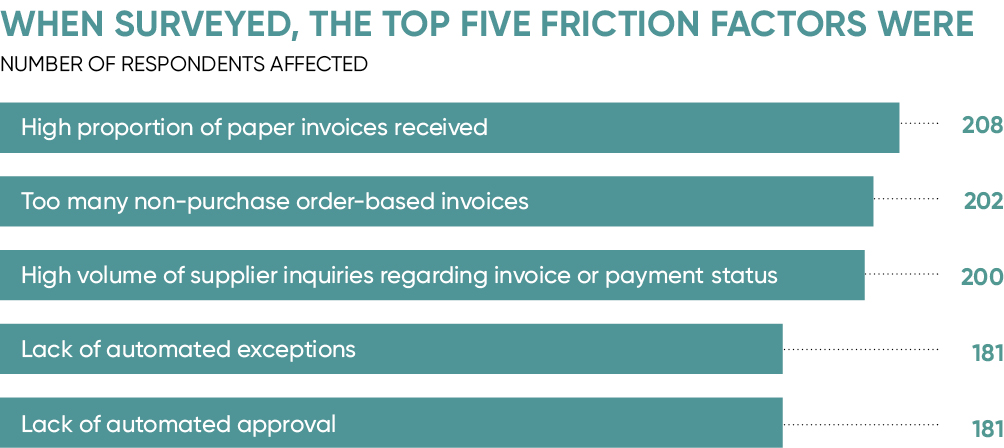

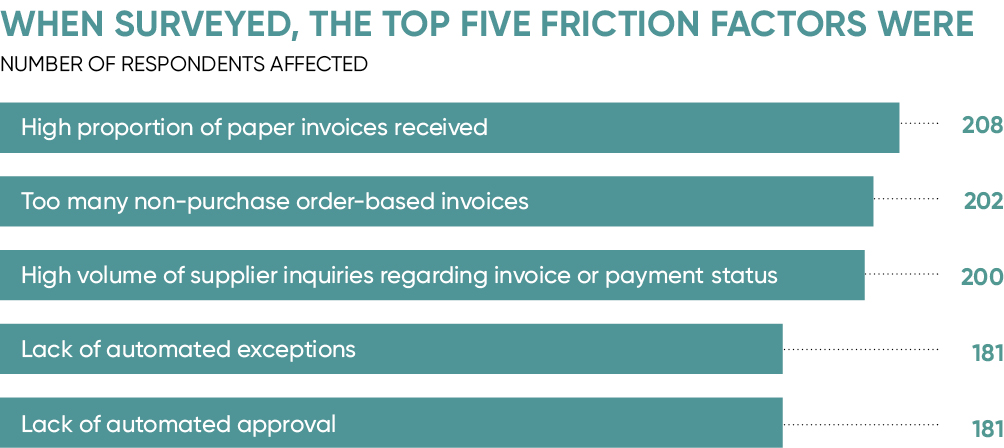

With so much going on, it’s concerning that in a recent Ernst and Young CFO survey 51 per cent of CFOs said that they cannot focus on strategic priorities because of increasing operational responsibilities. On top of this, financial and administrative processes can remain inefficient and tedious, wasting time and energy. Identifying these points of friction is the first step towards removing them and in many cases a targeted approach to automation can reap real rewards.

Recently, Tungsten Network launched its inaugural Friction Index report to highlight how much time is spent on inefficient payment practices. It highlights that the average UK business loses £88,725 a year through supply chain inefficiencies, which equates to almost 6,500 team hours wasted every year dealing with payment issues. These include everything from chasing for purchase order numbers to processing paper invoices and responding to supplier inquiries. Understandably, given the wasted money and man power, 36 per cent of businesses said removing friction from the payment process is a top priority for 2017.

Technology can do away with these cumbersome and menial tasks, and instead boost productivity and efficiency

The Friction Index also explores which companies are most affected by friction in the supply chain. By calculating an index score out of 100 when analysing the current state of potential causes of friction and the priority level of removing friction from procure-to-pay processes, it was found that larger companies were most affected by friction with a score of 101.0, compared with medium-sized (99.7) and smaller companies (96.3).

Larger businesses could be more susceptible to supply chain friction because of international supply chains that can mean dealing with the additional tariff and compliance issues which vary by country. In the absence of automation, such demands add to the burden on accounts payable departments as they lose valuable resource chasing after payment and responding to queries.

One way technology is helping to reduce this friction is through automating the process with electronic invoicing. Digital technology provides a clear opportunity to streamline these processes and absorb the strains that are eating into the finance team’s time. Technology can do away with these cumbersome and menial tasks, and instead boost productivity and efficiency.

If businesses aren’t tied up chasing invoices or receiving phone calls from suppliers, they have more time to dedicate to expanding their global operations and driving growth. If all the data from past invoices is easily accessible, opportunities to identify variances that target efficiencies are more easily visible. If paper is completely eliminated from the process of paying global suppliers, the efficiency and accuracy of an accounts payable team is increased.

Digital transformation needs to come from the top, including the CFO. As highlighted in the recent Harvard Business Review report, What is holding back the digital revolution?, if senior executives aren’t driving the organisation’s developments then digital transformation is unlikely to happen or investments could be made in the wrong area.

As enterprises continue to expand, so will the expectation of what is required of the CFO. In this highly competitive business environment, there are no signs of this slowing and we will continue to see them doing more with less. Ultimately, this will see CFOs become more dependent on technology that can ease friction and free up time, and they will be instrumental in driving technological change and adoption.

Exploiting the digital revolution can bring businesses into a frictionless world, where finance teams run efficiently, operate with greater control, and are allowed to focus their efforts on strategic and growth priorities. It is the introduction of technology such as e‑invoicing that will enable CFOs to move beyond the numbers and adapt quickly to meet the new demands of their role while helping to solve wider business challenges.

To find out your business’s Friction Score please visit FrictionFinder.com

Rick Hurwitz discusses the importance of removing friction and moving to a digital environment