The global technology industry is facing shockwaves as the outsourcing trend of the past decade goes into reverse. Where once the world’s businesses handed over the management of all their tech needs to single IT giants, today they are more likely to work with a wide number of specialists.

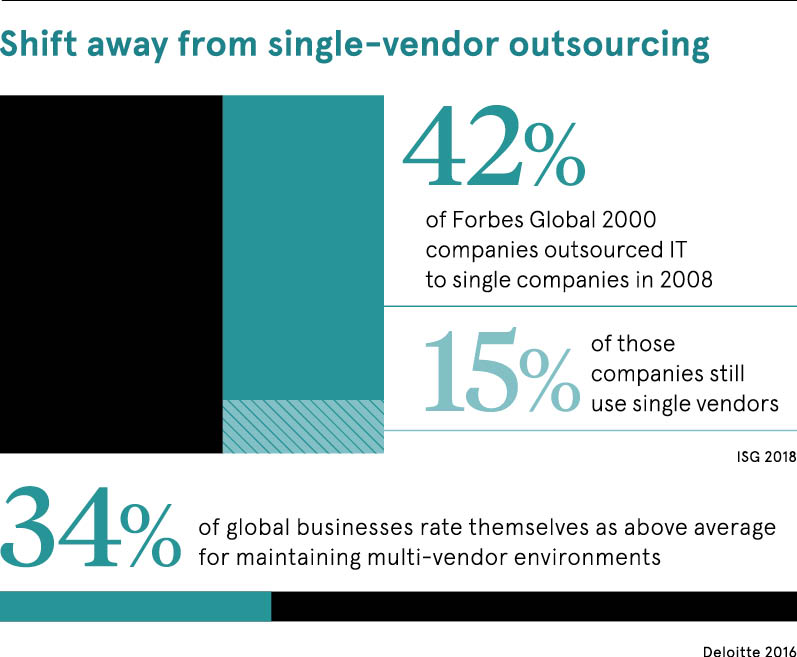

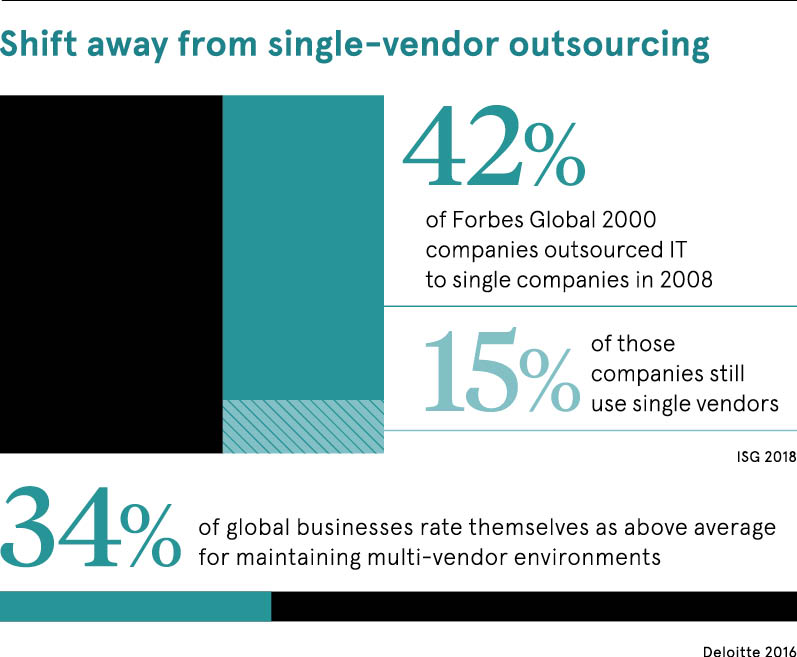

The shift away from single-vendor outsourcing has been stark. Consultancy ISG says its data shows that in 2008, 42 per cent of the Forbes G‑2000 largest global businesses outsourced IT to single companies, but now that has declined to just 15 per cent. This is having a damaging impact on many IT giants that offered businesses significant cost-savings and economies of scale, often using low-cost expertise in India.

“Traditional outsourcing in technology is changing as much as it has at any time in its history,” says Steven Hall, president, Europe, Middle East and Africa, at ISG. Driving this change is the rise of software-as-a-service and the cloud. “The client says that instead of going to IBM, DXC, Capgemini, ATOS or one of the Indian providers to run my datacentre, I’m actually going to move my workload and applications to Amazon cloud. Or instead of doing human resources applications in-house, I’m going to move them to Workday,” explains Mr Hall.

Over the past five years, a range of revolutionary technologies have come to fruition that are set to transform business processes, from cloud services and edge-to-cloud computing to robotics, artificial intelligence (AI), machine-learning, blockchain and the internet of things (IoT). Many of these technologies are offered by specialist startups. Client companies are partnering with these specialists, while established IT giants are looking to acquire them as they expand their offers into the new fields.

In future, no single company will have all the technology skills necessary to run business operations, says Manish Vyas, president of communications, media and entertainment at Indian IT giant Tech Mahindra. “The speed at which tech is attacking us is crazy. The world will move towards specialisation and software is not just something to outsource; you have to have capabilities in-house and you will need a collaboration model.”

But some wonder whether collaborating with multiple IT specialists rather than outsourcing to a single partner will create more problems than it solves. Chief information officers (CIOs) and chief data officers are faced with overseeing many different providers, and extracting the best value for money and efficiency from them. This introduces a high level of complexity and multiplies the threats to data security and privacy, ramping up the dangers of outages if problems hit any one of these technologies.

To address this, a range of mid-sized IT vendors are offering to integrate the multiple specialist providers. Luxoft is a Swiss-based software business spun off from a Russian IT firm. It employs 13,000 staff, many in Eastern Europe, and many of whom are highly qualified data scientists and software engineers. They can both build specialist technology services and integrate the multiple services used by businesses.

As managing director for digital enterprise Sam Mantle says: “We compete against the large Indian companies and giants such as Accenture where they have pockets of excellence. Then we compete against very niche vendors that are the best in world at IoT or machine-learning.

“But where they struggle is that they are not able to connect the dots between their niche areas of expertise and the broader set of capabilities you need to implement machine-learning. We are in a sweet spot; we can connect the dots across those different tech stacks and relate them to the industry domains where we operate.”

Mr Mantle cites niche specialists such as Ensono, a provider for cloud services and devOps – aiming to unify software development and operation – Precision Health AI and specialist blockchain provider Datarella.

For Punit Bhatia, partner at Deloitte UK who specialises in outsourcing, a big reason for the demise of large monolithic outsourcing contracts is that they often failed to deliver on their promises. Clients thought they were buying a single integrated service, but, as Mr Bhatia says: “They found the organisations were so big, you may as well be dealing with multiple providers. They weren’t co-ordinated enough. You talk to the infrastructure arm, the applications arm, then business process outsourcing; they speak different languages and can be difficult to co-ordinate among themselves.”

Once you have mastered the process of managing multiple vendors, you will understand the value of this approach and see the value it brings to the organisation’s growth and success

He points out that outsourcing decisions vary by department. Finance is rarely split into different contracts because it requires too many handovers of data between providers. If something goes wrong, it can be impossible to identify which supplier was at fault. But in human resources, there is no single service which solves all the challenges. There are only two or three providers that handle payroll globally, while learning and development is often done regionally. HR often has little choice but to use multiple providers.

The single-vendor model can be attractive to mid-sized companies, says Mr Bhatia, as breaking IT work into specialisms would make the projects too small to warrant much attention from each tech specialist. Pooling all spend into one provider gives greater firepower. He cites specialist robotic process automation companies such as Blue Prism, Automation Anywhere and UiPath.

Meanwhile, Serhiy Kozlov, founder of software company Romexsoft, points to Deloitte’s 2016 Global Outsourcing Survey, which shows that 34 per cent of companies rate themselves as above average for maintaining multi-vendor environments. “Once you have mastered the process of managing multiple vendors, you will understand the value of this approach and see the value it brings to the organisation’s growth and success,” says Mr Kozlov.

Collaboration with tech startups and outsourcing to multiple vendors is here to stay. The challenge for CIOs is to discover how to make the multi-vendor strategy work effectively.