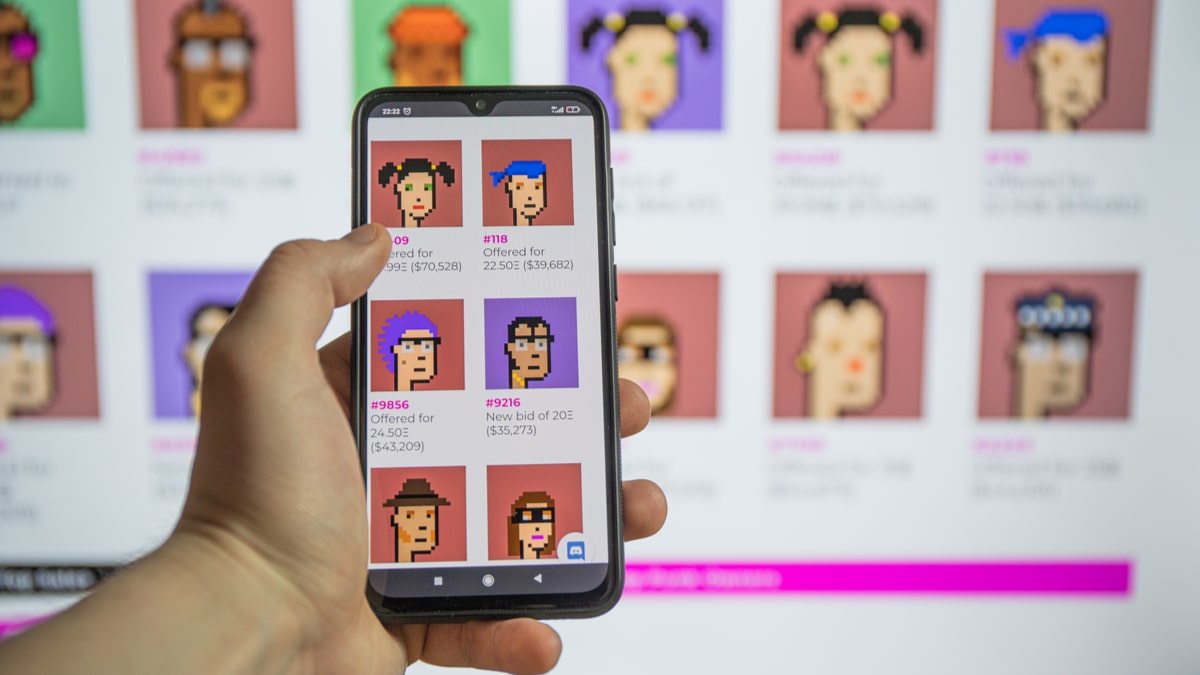

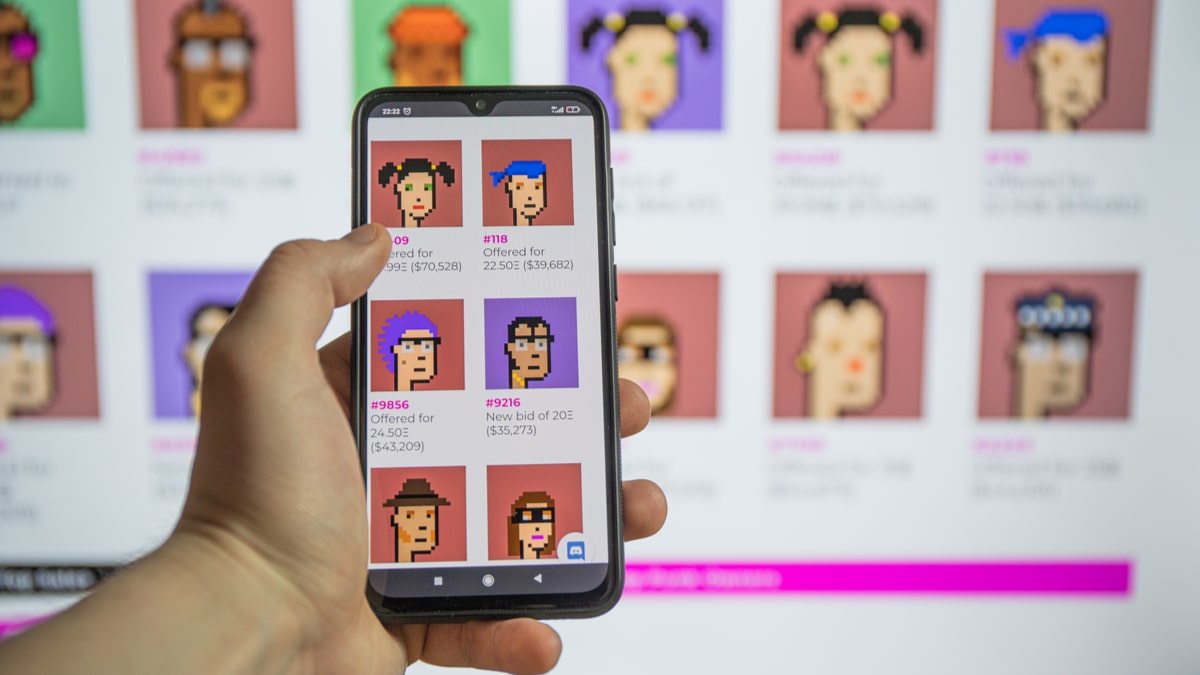

NFTs have been making headlines, but there’s confusion around what they actually are, the risks and benefits of investing, and whether people should be buying them at all

Unless you happen to be well versed in all things cryptocurrency and blockchain technology, non-fungible tokens, or NFTs as they are more commonly known, are likely to have entered your realm of consciousness only very recently. Or maybe you are learning about them for the first time.

Either way, in the space of a few short months, NFTs have gone from being niche digital assets, relegated to conversations between crypto natives, to headline-grabbing instruments used by high-profile creatives to earn eye-watering sums for their digital work.

But what exactly are they? What are the benefits and risks of investing? And should we all be buying them?

Non-fungible what?

First, you might be wondering what on earth “non-fungible” means. In layman’s terms, something that is fungible can be easily replaced with something else of the same type and equal value. If you consider a £1 coin, no matter which £1 coin you have of the millions of identical ones minted each year, it holds the same value as any other. Other examples of fungible assets include oil, gold, bitcoins and even a box of cornflakes: they are items whose value doesn’t depend on their uniqueness.

“If someone owes you £50, you’ll take any £50 note, you don’t care which; that’s because it’s fungible,” explains Antoni Trenchev, managing partner of Nexo, the leading regulated financial institution for digital assets and a member of Bulgaria’s parliament.

When something is non-fungible, it cannot be replaced with another similar item because only one of it exists in the world. Consider the Mona Lisa, arguably Leonardo da Vinci’s most famous work. Another painter could replicate the piece, and could do so quite accurately, but there would still always be minor differences; maybe the brush strokes or the tonality would differ slightly. A copy could never hold the same value as the original of which there is only one.

In simplistic terms, an NFT is a unique representation of value that provides creatives with the opportunity to produce one-off pieces of art in the digital world, where a normalisation of mass reproduction, streaming, downloading and uploading has driven down the value of their work.

Content creators will become so much richer in the next few years or decades thanks to this kind of innovation

An NFT also enables artists to sell directly to consumers, thereby increasing profits, and have a built-in function to pay creators when their work is sold on. They are like virtual collectibles that can be bought, sold or traded for money, either as speculative assets or as a way for brands, as Nike has recently announced, to verify the authenticity of a product.

For Lior Messika, founder of Eden Block, a venture capital firm specialising in blockchain and crypto, the potential for NFTs is “colossal” in terms of their ability to “disrupt the entire concept of digital ownership”.

“More than anything, NFTs represent a shift in current business models,” he says. “If blockchain as an operating system is helping us to do things differently, NFTs are just another way of distributing value in a way that is frictionless.”

This, he believes, will benefit both creators and consumers. “Blockchain technologies are extremely effective at fixing the problems we created by moving too fast with the internet,” says Messika. “Content creators will become so much richer in the next few years or decades thanks to this kind of innovation, which will eventually feed through to consumers.”

It began with a tweet

If it seems like everybody is suddenly talking about NFTs, it’s because they are. Trenchev says: “Despite the fact they’ve been around for a few years, we’re hearing a lot more about NFTs recently because there have been some crazy auctions, with art selling in double-digit millions.”

He attributes at least some of this to global lockdowns, which have hit the finances of major recording artists who would ordinarily make a big part of their income from touring. It’s a trend that has seen Kings of Leon become the first band to release an album as an NFT and singer Grimes sell $6 million-worth of digital art in tokens. Twitter’s founder Jack Dorsey made headlines in March by auctioning off his first-ever tweet as an NFT for almost $3 million and Kevin Roose, a journalist at The New York Times, made $560,000 for charity by selling an NFT of one of his columns.

Trenchev also believes that skyrocketing prices for bitcoin and other cryptocurrencies in 2020, which brought massive financial gains to investors, are behind an increased interest in NFTs. “There are millennials and Gen Zedders, who suddenly find themselves sitting on an enormous amount of wealth created seemingly out of thin air, and they’re looking for ways to spend it,” he says.

He adds that while “previous generations view hard assets to be real estate, cash and bonds”, this doesn’t mean the next generation is going to dance to the same tune. Such investments might not seem so strange to generations who have grown up online.

Where can I sign up?

Expert opinion differs on whether NFTs are a worthy investment. “It’s still too early to say if this is a good investment,” says Trenchev. “But I’d definitely say it’s an overheated and overpriced market.”

Messika is more upbeat. “It’s the same as every other asset class and basically depends on whether or not the NFT is good or not,” he explains. “Being an NFT doesn’t make it more or less valuable, but I own a few and I feel confident they’ll hold value. Overall I think the market will grow.”

Outside investment, though, are they a worthwhile expenditure for the average consumer? Gem Stoned, a content creator, thinks so. “I’ve bought two, sold two and minted several,” she says. “I really love art and crypto, and I love that NFTs give you the ability to support the artist directly while owning the piece as an asset that can hopefully go up or hopefully not go down in value.”

If you decide to give it a go, it’s worth bearing in mind that making digital artworks uses a large amount of computing power, so NFTs are not particularly environmentally friendly. Beyond that, Trenchev and Messika agree you should start small. “My advice is always the same,” says Trenchev, “never put any money into a financial asset that you cannot afford to lose.”

Related Articles

NFTs have been making headlines, but there’s confusion around what they actually are, the risks and benefits of investing, and whether people should be buying them at all

Unless you happen to be well versed in all things cryptocurrency and blockchain technology, non-fungible tokens, or NFTs as they are more commonly known, are likely to have entered your realm of consciousness only very recently. Or maybe you are learning about them for the first time.

Either way, in the space of a few short months, NFTs have gone from being niche digital assets, relegated to conversations between crypto natives, to headline-grabbing instruments used by high-profile creatives to earn eye-watering sums for their digital work.