It is becoming increasingly clear that there is a significant disconnect between the requirements and expectations of the client and the current communication and reporting provisions made by most wealth management organisations.

This is a problem for many existing wealth managers because, if it is not addressed, they face disruptive competition from providers who will employ the technology that is expected and already used in other aspects of their clients’ lives.

The wealth management sector is changing; there is greater demand for transparency, and an ever-changing regulatory landscape, coupled with on-going political and economic uncertainty. Latest figures, reported by the British Bankers’ Association from Wealth of Opportunities II, show the sector is growing, with UK clients’ assets under management last year at £226 billion, up from £97 billion in 2011.

Within wealth management, the communications and reporting function’s responsibility has changed too. It is not only used to report activity, positions, quarterly or annual performance. Across the enterprise, it is also used to deliver data of increasing complexity, richness and volume to any stakeholder who is interested in the manager-client relationship.

If we won or retained one client with a fund size of £22 million at the standard fee scale, this would pay outright for the system running costs for that year

- Craig Watts, director, Smith & Williamson

As such, communications and reporting technology are a vital part of a wealth manager’s toolkit, jostling for position with trading, research, analysis software and associated feeds, data utilities, accounting, and reconciliation platforms and other requirements necessary to operate a successful wealth management organisation.

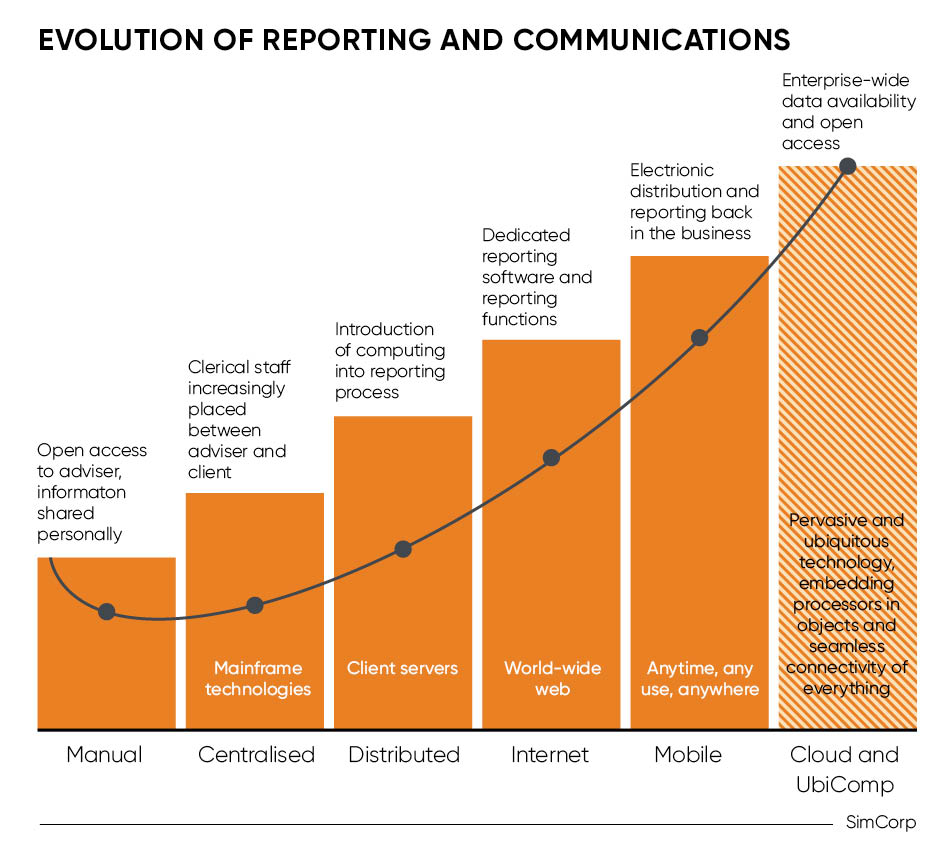

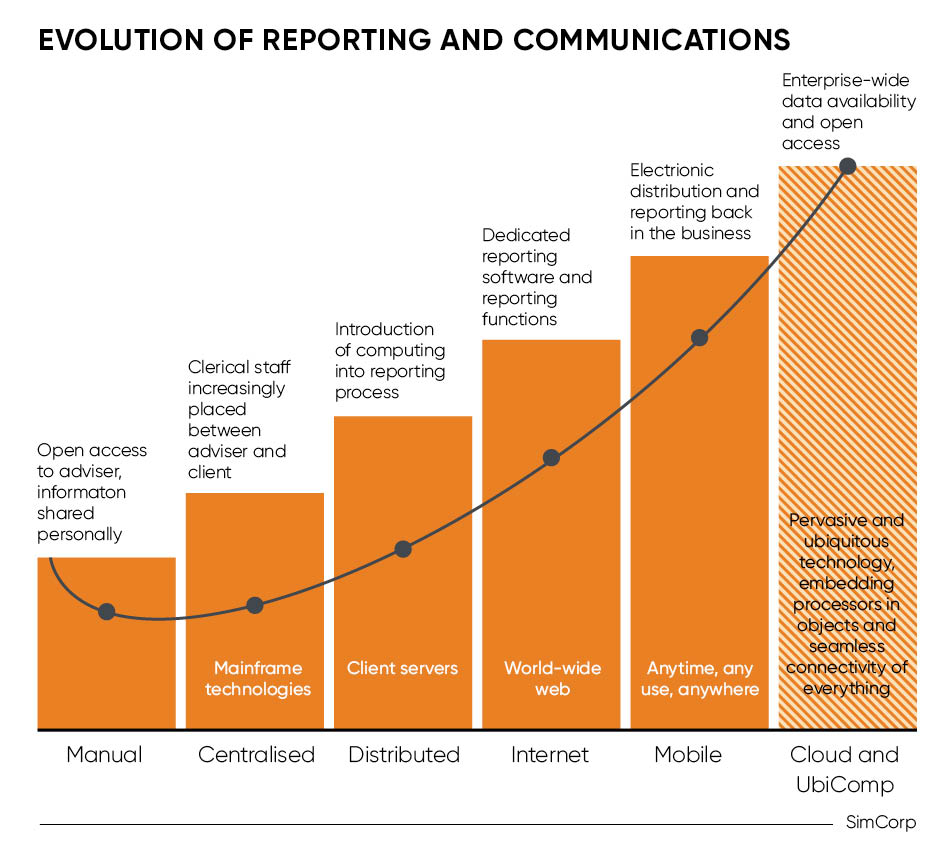

Communication and reporting, in a period of change and disruption, has evolved alongside other aspects of the sector. Currently, it is a function that is owned by “the business” that designs and distributes information according to the requests or mandate received. In the near future, it is likely that we will see a shift towards organisations providing a gateway to data, and the clients themselves deciding what they want to see and when they want to see it. To illustrate this evolutionary change, we can study the provision of reporting over the last 50 years or so:

Pre-1970s: STAGE 1 (Manual)

Client reports and statements are handwritten, and are likely to be discussed in person, face to face with the client in review meetings.

1970s/1980s: STAGE 2 (Centralised technology, mainframes)

Client reporting is produced manually. It is likely that the content is created by investment specialists and typed by clerical staff before being distributed to clients. Distribution is usually via mail and accompanied by face-to-face discussion with those personally responsible for the business-client relationship.

1990s: STAGE 3 (Distributed technology, client servers)

Computers are used to produce reports, using a combination of early word processing, desktop publishing and spreadsheet software. Distribution is largely via mail and accompanied by face-to-face discussion with client advisers, relationship managers or portfolio managers.

2000s: STAGE 4 (Emergence of the internet)

Reporting software is used, introducing standardisation and efficiency into the reporting process. Reporting is owned by the IT function, and report design, production and distribution facilitated by them, with input from relevant stakeholders. Distribution is increasingly electronic.

2010s: STAGE 5 (Mobile)

Reporting is moving out of IT and is now owned by “the business” as reporting software has evolved to allow ease of design and production. Distribution is primarily electronic. Business users are able to build reports quickly and efficiently to meet consumer demand.

2020s: STAGE 6 (Ubiquitous computing)

Once Stage 5 has become the new normal, it seems logical that the next step in its evolution would be to pass the design of the report to the consumer, which isn’t necessarily always the client. Reporting software will be the mechanism for information distribution and the consumer will have – and want – the ability to customise their data for their own purposes. In doing so, reporting itself changes. Most consumers will not be building complex reports to match their own designed periodicity. Instead, organisations will provide access to data and consumers will pick the data or calculation of data that they want to see. Traditional, regular reporting thus becomes obsolete and the “always-on” and “always-available” model is implemented. As such, reporting and communication technology becomes a means to provide data as well as its calculation, interpretation and display.

Interestingly, even those organisations that have reached Stage 5 are not facilitating communication through the channels currently available and commonplace in other aspects of a client’s life. Advisers aren’t generally available via live video or online chat and do not typically loiter on social media, with all of the accessibility that comes with this.

This may be due to information security concerns, confidence with modern communication media and perceived difficulties in connecting such technology to existing platforms. Additionally, there are those in the industry who prefer to offer services via more traditional channels. It is these organisations in particular who are likely to struggle to remain competitive in the next decade.

Increasingly the successful firms will be the ones that utilise smart technology to improve the customer experience

— Steve Young, managing partner, Citisoft

If an organisation is willing to adopt new working practices, the technology is available and it can be connected to existing platforms seamlessly. Quality client communication and reporting can be a value driver and prospective clients are likely to be drawn to market leaders in this space.

As advanced communication and reporting technology becomes commonplace, and enterprise-wide data is available to all stakeholders, and connected and interfaced where required, a wealth manager needs to establish or retain their differentiators to position themselves in the sector.

It makes sense, therefore, to allow a technology partner to provide the mechanism of operations, so the organisation can concentrate on the distinctive elements of their business, such as research, performance and client service. Doing so enables energy, time and budget to be expended on those areas where expertise is in abundance. Taking this decision displays and highlights critical strategic thought, putting your clients’ interests above your own.

SimCorp Coric is a best-in-class enterprise client communications and reporting solution used by 80 private wealth and institutional asset management firms globally to automate their end-to-end reporting processes and enhance client service. SimCorp Coric is fully owned by SimCorp, a leading provider of integrated investment management solutions for the global financial services industry, listed on NASDAQ Copenhagen.

For more information please visit www.simcorpcoric.com