Imam Hoque, Chief operating officer and head of product, Quantexa

Just as the Industrial Revolution transformed the world during the 18th and 19th centuries, we are facing the dawn of an equally far-reaching artificial intelligence or AI revolution that will be measured in years rather than decades. AI has reached the point where it is capable of surpassing the decision-making of humans in many situations; consistently, accurately, 24/7 and based on more facts. But why now and how do businesses harness this capability?

AI has been around since the 1960s; only now is the confluence of three key factors coming together. Firstly, AI has languished as a “disembodied brain in a jar”, isolated from the real world. Today we have reached the point where digital channels are becoming the norm, providing the brain with all the senses and limbs it needs. Our customers and suppliers communicate with us electronically, so why place a human in the loop to make decisions?

Second is the availability of data, the new “digital fuel”. Data lakes are popping up everywhere, application programming interfaces or APIs are available on the internet to access all manner of data, and we as individuals and businesses are generating a huge but insightful “digital exhaust”.

Finally, whereas steam machines were fashioned out of steel with large capital investment, huge cloud compute capacity can be provisioned in seconds for dollars. The AI revolution is set to take the service industry by storm, with the potential to change the role of the white-collar worker irreversibly.

OPPORTUNITY FOR THOSE WHO RACE TO EMBRACE AI

This is a truly global race; the opportunity is automating or augmenting many decision-making tasks in real time, more accurately using more facts. The starting gun has been fired, there is a pack out front – the global internet players: Amazon, PayPal, Google, Facebook and friends. The stakes are further compounded by government regulation driving competition through open banking and the revised Payment Services Directive.

If the global internet brands steal a march, with their low cost-bases, seamless real-time interaction and highly competitively priced products, it could prove hard to catch them.

AI can generate significant insight into your customers, suppliers and business relationships from huge volumes of seemingly disparate sources of data. This underpins the ability to make automated unique decisions per individual or organisation on a whole range of topics. It can also identify hidden trends and patterns of behaviour.

The applications are potentially limitless and have a profound impact on headcount as well as opportunities for more innovative offerings or significantly improved customer service.

CASE STUDIES

Imagine being able to create 80 per cent more, targeted, potential customer prospects and complete the pre-qualification automatically. By combining global lists of businesses, directors, investors and shareholders, along with your own current customer base, AI systems can do just that. They will work out what your best customers look like, scour the global lists, find similar businesses, rate them based on a whole range of factors, present you the best opportunities and even go as far as telling you which of your current customers could make an introduction.

The AI revolution is set to take the service industry by storm, with the potential to change the role of the white-collar worker irreversibly

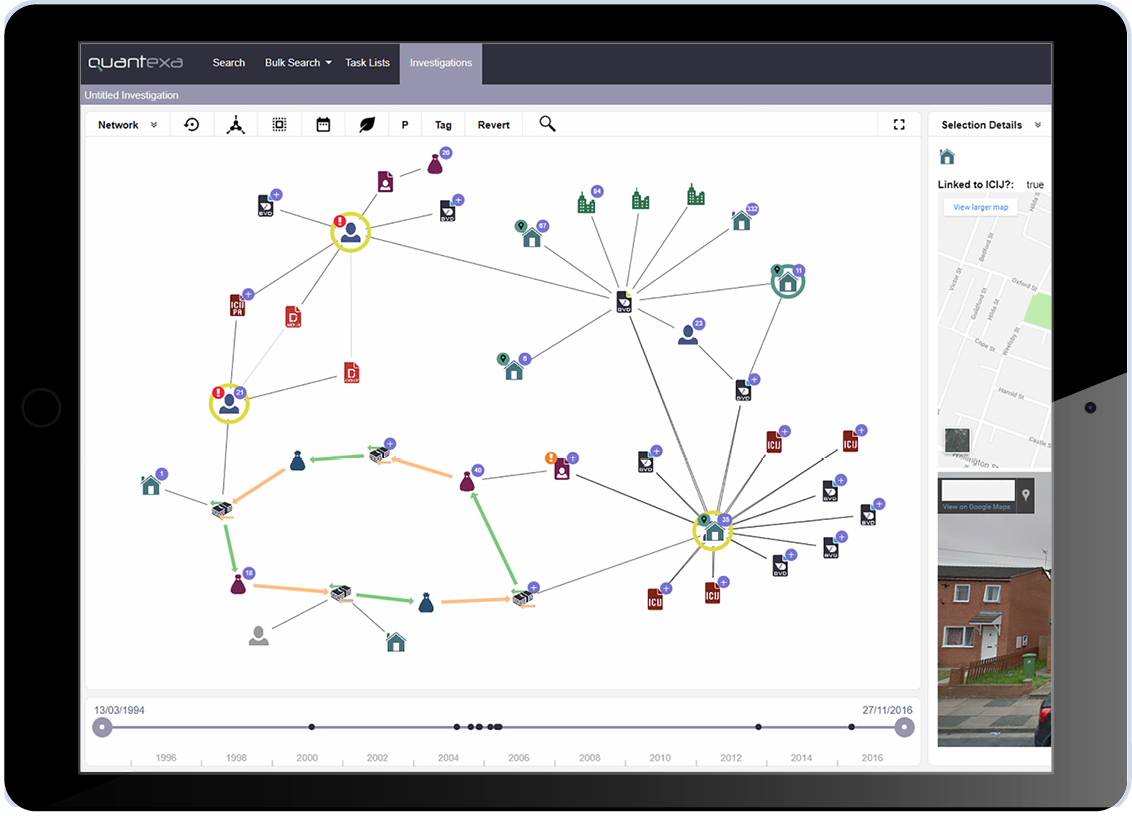

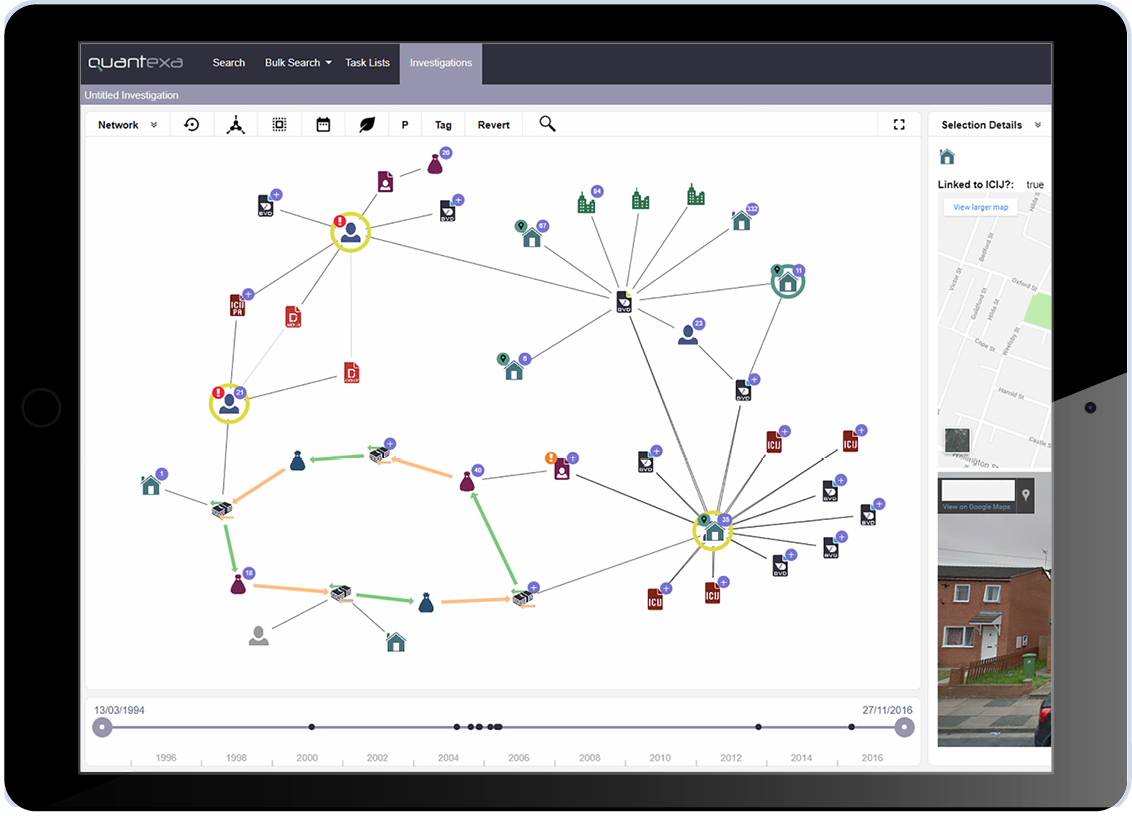

The cost of compliance is a huge burden, with financial institutions deploying tens of thousands of staff to perform know-your-customer, sanctions checks and anti-money laundering transaction monitoring, reacting to adverse media or Panama leaks. By producing a full contextual view of prospects and customers, linking data across many sources, AI systems can auto-classify for potential criminality far more accurately than traditional rule-based systems or humans following rules.

Identifying more illicit money movements, and by improving the 98 per cent false positive rates, AI can save up to 70 per cent of staff effort. This is critical to making a real impact on the proceeds of crime, reducing organised crime, human trafficking, terror, radicalisation, inequality through tax evasion and corruption.

Predicting risk of default more accurately is possible when AI is provided more context about a business being assessed. After all, you would not buy a house by looking through the letter box; you would go inside, look around the neighbourhood and then make your decision. Likewise, using shareholder and director relationships, even the businesses’ own customers and suppliers networked together will drive superior AI decision outcomes.

SECRET TO AI SUCCESS

Step 1: Getting your data prepared

Organisations understand that data creates business and customer insight, and their response has been to set up a chief data office and data lakes. Not all have seen the value, however, as they have not yet plumbed in automated AI decision-making. People also panic about data quality. Don’t, it will never be perfect; AI is a game of statistics and you can use quantity of data to overcome quality. Start by making sure you generate a statistical single view of a customer, don’t wait for some master data management programme to complete as you’ll miss the starting gun. Context is critical; the AI engine needs to be fed with networked data providing the full picture to make decisions. For example, why assess a claim in isolation, when looking at the network of connected claims would prove it is genuine or an organised fraud ring. Finally, ensure you can generate single customer views and networks in real time, not just old-fashioned batch.

Step 2: Understanding AI

Don’t confuse AI with robotic process automation, which is a basic capability that introduces another computer to try to automate existing legacy computers by following the same rules a human operator would. AI is a step-change to achieve superior decisioning based on deeper insight and more data. Don’t only think AI is about machine or deep-learning; AI is more effective as a combination of techniques, effectively creating an expert system.

Step 3: Find the right problems

Organisations that have struggled with AI have succumbed to one of an unsuitable problem, the data was not prepared correctly or users were alienated – “computer says no” syndrome. It is very important to select carefully the problems that make a real difference and ensure the right data is available. To solve the user-interaction problem, don’t just think of AI as purely machine-learning – a yes/no answer. Engage users to derive expert system-type rules and models. Then ensure the interface presents the full picture and reasons underpinning the decision back to the user, effectively amplifying your best decision-makers.

Step 4: A well-structured programme

You need streams of work to underpin a series of AI pilots and projects – data acquisition, data sciences skills, open technology data-lake environments, IT engagement, pilot-to-production process, awareness and communicating success. Don’t wait for the race to be won, make a start today, take baby steps and reap the benefits of success.

For more on single customer view, context, networks and AI-driven decisions please email [email protected] or visit www.quantexa.com

OPPORTUNITY FOR THOSE WHO RACE TO EMBRACE AI

CASE STUDIES